Risk Simulator is a powerful Excel add-in software and is used for running multiple scenarios and simulating uncertainties for the purposes of forecasting and risk analysis. We pride ourselves on a simple easy-to-use interface backed by highly sophisticated computational and simulation engines. This software is also used for forecasting time-series and cross-sectional data, as well as for portfolio optimisation.

Together with SLS Software, the tools can help you identify, quantify, forecast, value, diversify, and hedge risks. Use these advanced analytic tools to maximise your profits, drive your revenues, reduce your costs, cut down on development time, and increase product and service quality. Instead of relying on guesses in traditional modelling and decision analysis, push the envelope and take your decision analysis to the next level. Use these tools to gain valuable insights into your decisions, create the risk and return profiles of your projects, and quantify ways to mitigate your risks. Using your existing Excel models, add these risk analysis technologies to identify your project’s or asset’s critical success factors, to predict and quantify risks, and to define strategies to mitigate these risks.

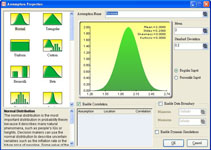

Advanced analytical tools such as the Risk Simulator and SLS software might be easy to use but may get the analyst in trouble if used inappropriately. Sufficient theoretical understanding coupled with pragmatic application experience is vital; therefore, training is critical. The Risk Analysis course is a two-day seminar focused on hands-on software training. Topics covered include the basics of risk and uncertainty, using Monte Carlo simulation (pitfalls and due diligence), truncation, correlated simulations, statistics for interpreting the results, distributional fitting, bootstrap simulation, sensitivity analysis, forecasting (time-series and cross-sectional forecasting), extrapolation, stochastic process forecasting, linear optimisation (integer and continuous optimisation), and many more exciting topics.

Other courses are also offered, including Real Options for Analysts for the analysts who want to begin applying real options in their work, but lack the hands-on experience with real options analytics and modelling. This two-day course covers how to set up real options models, apply real options, and solve real options problems using simulation, closed-form mathematics, and binomial lattices. It focuses on detailed case studies and practice valuation models using the Real Options SLS software. Also available are other risk analysis courses with an emphasis on customised on-site trainings (simulation, forecasting, optimisation, and real options trainings customised to your firm’s exact needs based on your business cases). Consulting services are also available, including the framing of risk analysis problems, simulation, forecasting, real options, risk analytics, model building, decision analysis, and software customisation.